For the fiscally conservative municipality of Mississauga, the writing is on the wall; sewer infrastructure needs upgrading and everyone has to get behind the wheel. The Toronto Star’s Urban Affairs reporter San Grewal says “Mississauga — a city known for asphalt, an iconic sprawling shopping mall at its centre and suburban-style monster homes — has a message: if you want to keep paving paradise, get ready to pay more.”

Propping up the likely unpopular tax, city Councillor George Carlson suggested the existing undersized storm water sewer system needed to be upgraded from “Dixie straws” to massive culverts. The Toronto Star article went on to say “In a move that’s a first for the GTA, Canada’s largest suburb and its sixth largest city will soon charge home owners and businesses for storm water costs based on how much of their property is covered.”

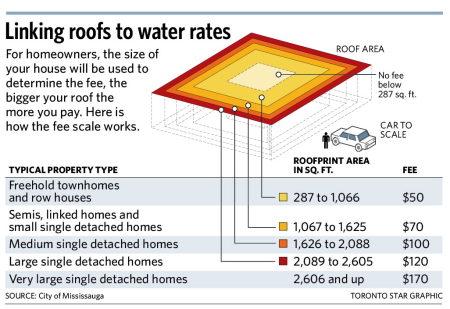

As a response to widespread flooding in 2013, Carlson said there were “streets in Mississauga that looked like Venice” and the city needed to upgrade sewer infrastructure. What the Toronto Star suggested was a tax on the rich’s “McMansions” isn’t really accurate given that the tax in question tops out at $170 per year for roof with a footprint over 2606 square feet. Hardly a tax at the cost of one Starbucks latte a week!

At the lower end, the municipality won’t be taxing homes with roof areas smaller than a 17′x17′ (less than 287 square feet), but let’s be frank there are virtually no homes in Mississauga under 287 sq.ft. CMHC suggests that the average floor area for a mobile home is 1,200 square feet (in the USA it ranges from 600 to 1,335 square feet ) which would be taxed $70 annually whereas the largest house in the Municipality would be charged mere a $100 more. So really, this is a tax on low and middle income, average home owners.

The proposed new tax would cost the homes on the left (~2000sq.ft) $100 annually and on the right (720 sq.ft) $50 yearly, though CMHC suggests the average is CDN mobile home comes in at 1,200sq.ft for a yearly tax of $70. Left image courtesy of Wikicommons.

To dissuade developers and builders from building McMnsions, the city should have based its calculation on the actual bell curve of roof areas and taxed more heavily on the far side of the curve to place a value on land area. It should have also included the area of the driveway with a factor that discounted its area if it the surface was permeable.